- Real Value Of Money Price Level Definition

- Historical Value Of Money

- What Is Real Value Of Money

- Real Value Of Money Calculator

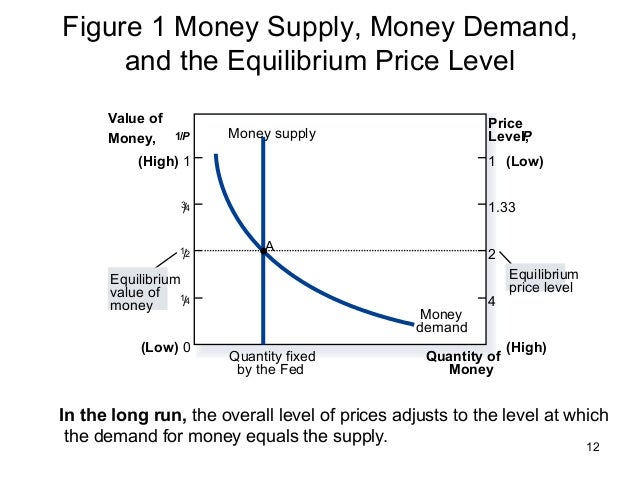

- An increase in the price level (P $) causes a decrease in the real money supply (M S /P $) since M S remains constant. In the adjoining diagram, this is shown as a shift from M S /P $ ′ to M S /P $ ″. At the original interest rate, i $ ′, the real money supply has fallen to level 2 along the horizontal axis, while real money demand remains at level 1. This means that money demand exceeds money supply and the.

- Real prices and ideal prices. The distinction between real prices and ideal prices is a distinction between actual prices paid for products, services, assets and labour (the net amount of money that actually changes hands), and computed prices which are not actually charged or paid in market trade, although they may facilitate trade.

(V ) is the velocity of circulation of money in the economy; (P ) is the price level; and (Y ) is the real output. Thus, the amount of money used to purchase goods and services in an economy, M × V, is equal to the money value of this output, P × Y. However, if the velocity is constant, then the spending P × Y is relatively proportional to M.

Introduction

Definition: The nominal price of a good is its value in terms of money, such as dollars, French francs, or yen. The relative or real price is its value in terms of some other good, service, or bundle of goods. The term “relative price” is used to make comparisons of different goods at the same moment of time. The term “real price” tends to be used to make comparisons of one good to a group or bundle of other goods across different time periods, such as one year to the next.

Examples:

Nominal price: That CD costs $18. Japan’s science and technology spending costs its taxpayers about 3 trillion yen per year.

Relative price: A year of college costs about the value of a Toyota Camry. Those tickets to see Lady Gaga cost me three weeks’ worth of food.

Real price: The real price of coffee rose in the last year, so to buy a pound of coffee I now have to skip a day of croissants or buy fewer songs on iTunes. My cost of living rose 2% last year in real terms.

When we say that the relative price of computers has fallen in recent years, we mean that the price of computers relative to or measured in terms of other goods and services–such as TVs, cars, tickets to the Super Bowl, or how many hours you have to work to buy a computer–has declined. The opportunity cost has fallen.

When economists talk about prices, they always mean relative or real prices, even if they use dollars to express themselves succinctly in conversation. Most of the time, you can be pretty sure that if the nominal price of a bag of chips goes up from $1.00/bag to $1.05/bag (that is, by 5%), its relative price when compared to other goods has also increased by 5%. Economists usually give examples using nominal prices because nominal prices are familiar and easy to understand. Nominal prices are the equivalent of relative prices except in times of inflation.

Although the real price of a good or service is just another term for its relative price, the term “real price” can be a little confusing. It tends to used to make comparisons of groups or bundles of goods and services across time.

Let’s say every month you go to the store and buy the same group of things–say, 4 bottles of soda, 2 bags of chips, 1 jar of salsa, and 1 pack of paper plates. You can compare the total price of that bundle from one month to the next. Suppose for several months the bundle always costs you $10/month. Maybe one month soda costs a little more and chips a little less, while the next month the chips cost a little more and the soda a little less, but the total is always $10. That is, the relative prices of soda and chips change from month to month, but the whole bundle costs the same amount each month.

Economists describe this common occurrence by saying there is no change in the real price of your bundle. Nothing changes on average from one month to the next.

Now suppose that suddenly one month the price of the whole bundle increases and you have to pay $11. Economists describe this by saying that the real price has risen by 10% (because [$11-$10]/$10 = 10%). They alternatively say that the bundle went up by 10% in real terms. Compared to the previous month, that same bundle of goods increased in price.

Real Value Of Money Price Level Definition

If you happen to include enough goods and services in the bundle, you could alternatively say there was a 10% inflation. Inflation means that the nominal prices of all goods and services in the economy increase on average. A 10% inflation means that the nominal cost of a bundle of everything you buy in total–including your rent, bus fare, movie tickets, food, etc.–has risen by 10%. (You could equally well describe this by saying your cost of living increased.)

Economists don’t have time to track your personal purchases, but they do track the prices of some very large bundles of goods and services and thereby create estimates of inflation. They use those estimates to adjust for inflation. If economists say that the real, or inflation-adjusted price of chips went up, they mean that the price of chips went up by more than overall inflation. That is, if the price of chips rises from $1/bag to $1.30/bag, and inflation or the average price of goods and services rose by 10%, the inflation-adjusted increase is only $.20 a bag (because the portion of the increase due to overall inflation would be 10% or $.10 more per bag).

Historical Value Of Money

Definitions and Basics

Real versus nominal value, at Answers.com

In economics, the nominal values of something are its money values in different years. Real values adjust for differences in the price level in those years. Examples include a bundle of commodities, such as Gross Domestic Product, and income. For a series of nominal values in successive years, different values could be because of differences in the price level. But nominal values do not specify how much of the difference is from changes in the price level. Real values remove this ambiguity. Real values convert the nominal values as if prices were constant in each year of the series. Any differences in real values are then attributed to differences in quantities of the bundle or differences in the amount of goods that the money incomes could buy in each year….

National Income Accounts, from the Concise Encyclopedia of Economics

In practice BEA first uses the raw data on production to make estimates of nominal GDP, or GDP in current dollars. It then adjusts these data for inflation to arrive at real GDP. But BEA also uses the nominal GDP figures to produce the “income side” of GDP in double-entry bookkeeping. For every dollar of GDP there is a dollar of income. The income numbers inform us about overall trends in the income of corporations and individuals. Other agencies and private sources report bits and pieces of the income data, but the income data associated with the GDP provide a comprehensive and consistent set of income figures for the United States. These data can be used to address important and controversial issues such as the level and growth of disposable income per capita, the return on investment, and the level of saving….

What Is Real Value Of Money

Real vs. nominal interest rates: Interest Rates, by Burton G. Malkiel. Concise Encyclopedia of Economics

People’s willingness to lend money depends partly on the inflation rate. If prices are expected to be stable, I may be happy to lend money for a year at 4 percent because I expect to have 4 percent more purchasing power at the end of the year. But suppose the inflation rate is expected to be 10 percent. Then, all other things being equal, I will insist on a 14 percent rate on interest, ten percentage points of which compensate me for the inflation. Economist Irving Fisher pointed out this fact almost a century ago, distinguishing clearly between the real rate of interest (4 percent in the above example) and the nominal rate of interest (14 percent in the above example), which equals the real rate plus the expected inflation rate.

In the News and Examples

How many days of work till you have paid your taxes? Tax Freedom Day. TaxFoundation.org

Tax Freedom Day will arrive on April 12 this year, the 102nd day of 2011. That means Americans will work well over three months of the year, from January 1 to April 12, before they have earned enough money to pay this year’s tax obligations at the federal, state and local levels.

Interest, by Paul Heyne. Concise Encyclopedia of Economics

The real interest rate on money loans will be the stated (or nominal) rate minus the anticipated rate of inflation. In countries that are experiencing rapid growth in the amount of money available, interest rates will be very high. But these will be not be high real interest rates. Instead, they will be high nominal interest rates. If expected inflation is 10 percent, for example, and if the real interest rate is 5 percent, the nominal interest rate is 15 percent. But someone who lends money at 15 percent for a year will not be repaid with 15 percent more resources at the end of the year. Rather, the lender will be repaid with 15 percent more money and will be able to use that money to buy only 5 percent more resources. …

Real Value Of Money Calculator

A Little History: Primary Sources and References

Irving Fisher, from the Concise Encyclopedia of Economics

Fisher was also the first economist to distinguish clearly between real and nominal interest rates. He pointed out that the real interest rate is equal to the nominal interest rate (the one we observe) minus the expected inflation rate. If the nominal interest rate is 12 percent, for example, but people expect inflation of 7 percent, then the real interest rate is only 5 percent. Again, this is still the basic understanding of modern economists….

Early understandings of nominal versus real/relative price changes in gold and silver markets. Chapter 5. English Currency Controversies, 1825-1865, by Jacob Viner, from Studies in the Theory of International Trade

In Hume’s account, changes in price levels thus play the predominant role in bringing about the necessary adjustment of trade balances, and are assisted only by fluctuations in exchange rates, held to be a factor of minor importance. In recent years a number of writers, most notably Ohlin, have contended that such an account leaves out of the picture an important equilibrating factor. These writers insist that much, or even all, of the equilibrating activity commonly attributed to relative price changes is really exercised by the direct effects on trade balances of the relative shift, as between the two regions, in the amounts of means of payments or in money incomes; that when disturbances in international balances occur, the restoration of equilibrium will or can take place unaccompanied by relative price changes or accompanied by only minor changes in relative prices; and that such changes if they do occur will not be, or are not likely to be, or need not necessarily be–which of these is supposed to be the fact is not always made clear–of the type postulated in the later classical doctrine as expounded by J. S. Mill or Taussig. While none of these writers seems to have applied his doctrine to a currency disturbance such as postulated by Hume, where the need for at least temporary price changes of some kind would seem most obvious, it may be assumed, nevertheless, that they would hold Hume’s analysis of the mechanism to be inadequate even when confined to such cases….

Advanced Resources

Related Topics

Inflation

Opportunity Cost

GDP