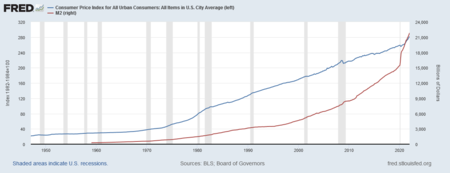

We can define the money supply in three different ways - M1, M2 and M3. M1 is the narrowest definition of money. M1 consists of coins and currency in circulation, checking accounts and traveler's. Jul 27, 2021 Here is the “M2 Money Stock” (seasonally adjusted) chart, updated on July 27, 2021, depicting data through June 2021, with a value of $20,388.9 Billion: Here is the “M2 Money Stock” chart on a “Percent Change From Year Ago” basis, with a current value of 12.2%. Aug 01, 2021 It is true that- Money supply growth brings more benefits to economy than troubles- The part of M2 created by bank’s lending and thus collateralized by real wealth may periodically cause chaos but barely hurt the state credit- Base money is the root of state credit/currency crisis but it is still fixable as long as we have no nuclear war, planet bumping, or severe climate change that stop.

MONEY SUPPLY SPECIAL REPORT

Practical Measurement and Analytical Uses of Money Supply in Assessing Inflation

Issue Number 44

August 3, 2008

__________

Overview

Excess supply of a commodity or product usually is reflected in downside pressure on its price, and the same is true for money. Excessive supply of money leads to its debasement, to a decline in its value that otherwise is known as inflation. Where money supply generally is an underpinning of economic activity, it also is the ultimate determinant of prices and inflation. At present, near-record high annual growth in the broadest U.S. money measure M3 is suggesting a significant inflation problem in the year ahead.

The most common question raised by SGS readers in the last year has been along the lines of: 'You are predicting rising inflation because of higher M3 growth, but what about this analysis that claims the lack of growth in the monetary base (or M1, or the Austrian Money Supply [a.k.a. True Money Supply], or some concocted measuring adding in commercial paper) is suggesting deflation.' Sometimes the question is posed in terms of the high level of credit defaults/losses collapsing money supply and causing deflation. Most recently, questions have shifted to: 'How can there be inflation during a recession?' Those points will be addressed in various sections of the report.

Many of the questions raised have been based on legitimate analyses, but there also is a diehard deflationist camp out in the markets and on the Internet grasping at whatever straws can be found in order to dismiss the current inflation threat. An example that comes to mind is the argument that the collapsing commercial paper market should be counted in money supply (if so there are a number of other instruments that should be included, and the numbers would not be collapsing). Such reminds me of Federal Reserve Chairmen Ben Bernanke and Alan Greenspan touting the lowest inflation rate they could find (the core PCE deflator), irrespective of its lack of relevance for consumers, in order to demonstrate how well consumer inflation has been contained by the Fed.[1]

The following money supply analysis explores the nature of monetary theory, and why — with different degrees of success — its key components cannot be meaningfully measured in today’s economy. While M3 is not the perfect money measure, it is the broadest and best practical measure that currently is available, although no longer from the Federal Reserve.

The push for developing new money measures has resulted from the apparent breakdown in traditional relationships between money and measures of the broad economy and inflation. The problem is neither the money measure nor monetary theory, but rather meaningful redefinitions and the gimmicking of inflation and the GDP/GNP measures that have altered the apparent relationships.

The general analysis also looks at how there can be inflationary recessions and hyperinflationary great depressions, though the emphasis here is on the money relationship to inflation, not to economic activity (previously discussed in the SGS newsletters of March 2006 and May 2007).

Various money measures are compared, and I explain my preference — indeed the necessity — for using the broadest money measure available as an indicator of future inflation. While money supply measures M2 and M3 have a fairly strong correlation, the broader M3 provides the most comprehensive picture of what is happening to money in the system. That said, the behaviors of the various other measures of the money supply are not at all inconsistent with the inflation signals currently being generated by strong annual M3 growth.

We have a number of clients who use money supply estimates in their financial modeling and analyses. As always, comments and questions are invited through the feedback available at the Contact Us tab at www.shadowstats.com or by e-mail to johnwilliams@shadowstats.com.

Monetary Theory

[Much of the material in this and the 'Inflationary Contractions' sections was published in the Flash Update of July 10, 2008.]

Discussion on inflation and deflation in the financial markets, the financial media and as generally discussed in the SGS newsletters usually centers on price changes in goods and services as traditionally measured by the CPI survey. Such, however, is not the same measure of price changes as encompassed in general monetary theory, where the relationship between money supply and inflation commonly is expressed as:

M x V = P x Q

In the preceding equation, M is the money supply. V is the velocity of money, as measured by the number of times the money supply turns over in a year, relative to the economy as reflected in nominal (not-adjusted for inflation) gross national product (GNP), where V = GNP/M. GNP is the broadest measure of U.S. economic activity and encompasses the more popularly reported gross domestic product (GDP).

In turn, nominal GNP = P x Q, where P is some measure of GNP deflator (prices/inflation) and Q represents some measure of physical quantity/volume, or a real (inflation-adjusted) GNP, as a measure of economic output.

So, the P, or inflation measure here, effectively is the GNP deflator, the change in which is a broader inflation measure than the CPI, since it covers costs of consumption for businesses, government and net exports, in addition to the costs of consumer spending on goods and services. In terms of the other variables, the price equation is:

P = (M x V) / Q,

where price level (P) equals money supply times velocity (M x V), divided by real GNP (Q). Typically, increases in the combination of money supply and velocity, relative to Q (real GNP) result in higher prices. A drop in Q (real GNP), as seen in recessions, also would be inflationary, in theory, if money supply times velocity increased or otherwise did not drop as quickly as real GNP.

There’s More to Money Inflation than Money Supply (i.e. Velocity). The crude equations shown above are meant to provide a sense of some the basics of general monetary theory. Unfortunately putting meaningful hard numbers into the equations is impossible, since none of the variables are measured adequately by extant money supply, inflation or other national income (GNP) data, but the theory can help explain what likely will be happening.

While there is ongoing argument as to what should be included or not included in money supply (M), no measure constructed so far, be it the monetary base or M3, is fully adequate. For reasons discussed shortly, when assessing the inflation outlook, I prefer to use M3, the broadest and best measure available at present.

Velocity (V) is just the ratio of nominal GNP to the money supply, no better or worse in quality than the numbers used in the numerator and denominator of the calculation. Velocity is important, though. For those looking at the small annual growth in the monetary base — claiming that there is no inflation there — they can be befuddled by a sharp increase in velocity, which tends to happen when interest rates are low, and particularly when inflation-adjusted interest rates are negative, as they are now. In like manner, declining velocity could provide an offset to the inflation suggested by surging annual growth apparent in M3, but, again, circumstances suggest that increasing, not declining, velocity is more likely at present, which tends to exacerbate the inflation issues suggested by the M3 growth.

Current measurements of GNP, both real (Q) and nominal and the related implicit price deflator (P) are virtually worthless, as discussed in various newsletters and the Primer Articles available at www.shadowstats.com. Consider, for example, the 'advance' estimate numbers just published for first-quarter 2008 GDP. With official annual June CPI inflation at 17-year high, the quarterly implicit price deflator showed the lowest level of inflation in 10 years. The result was reported continued real growth in GDP for an economy that is in contraction based on almost any other measure.

In general, real GNP is meaningfully overstated, the GNP implicit price deflator is meaningfully understated, and the nominal GNP measure does not come close to measuring actual economic activity (i.e. the underground economy).

Accordingly, anyone hoping to calculate actual monetary inflation, derived from the equations used above, faces a very difficult, if not impossible, task, given the current state of the data.

Inflationary Economic Contractions — Current Environment

Market wisdom suggests that recessions mean low inflation, but as seen with the current circumstance and in at least two historical recessions in the last several decades (specifically the 1973/1975 and 1980 recessions), recessions with significant inflation are a great deal more common than is spun by Wall Street.

As the severity of the current downturn has gained broader recognition, some in the deflationist camp have started to argue that the underlying fundamentals driving the economy into the ground also will lead to lower prices, actually triggering a deflation. Quite to the contrary, despite deteriorating economic and financial conditions, my outlook remains for rising inflation well into 2009 and for a situation that eventually will evolve into a hyperinflationary great depression, as outlined in the Hyperinflation Special Report of April 8, 2008.

Slowing economic activity, by its nature, tends to reduce inflation pressures generated by strong economic demand. The current circumstance, however, is one where inflation pressures have been dominated by commodity price distortions (primarily oil) and increasingly a weakening U.S. dollar and surging money supply growth, not from strong economic demand. The current circumstance is somewhat similar to the recession officially clocked from November 1973 to March 1975, which has been the deepest standalone economic contraction, so far, of the post-World War II era. The period was one of soaring oil prices in the wake of the Arab oil embargo, a generally weak dollar and double-digit annual growth in money supply M3.

The severe downturn of 1973/1975 was accompanied by high inflation, per official CPI reporting, with annual inflation averaging 5.2% for the year leading up to the recession, 10.7% during the 16 months of the downturn, and 7.9% in the year following.

The next recession, from January through July 1980, saw even higher inflation, with annual CPI averaging 11.6% in the year leading up to the downturn, 14.3% during the six months of economic contraction, and 11.4% in the 12 months that followed, through to the onset of the next recession. This was a period that again saw significant oil price increases, near-double-digit annual growth in M3 and mixed dollar pressures.

The 1981/1982 recession saw inflation drop sharply (7.5% average annual inflation, down from 11.4% in the 12 months leading up to the recession, and against 3.2% in the year following the recession), along with declining oil prices and some dollar recovery. The 1990/1991 recession (5.8% average annual inflation) and 2001 recession (2.8% average annual inflation) took place in somewhat milder inflationary environments, or at least under circumstances where reported CPI inflation increasingly was being suppressed by methodological changes (see the SGS Alternate-CPI measure on the Alternate Data tab at www.shadowstats.com).

No Deflation. The U.S. has not seen annual CPI deflation since several periods of minimally lower prices in the late-1940s through the mid-1950s (the latter being outside of a recession). Of the nine official recessions since 1950, none of them were deflationary. The last significant deflation seen in the U.S. was during the Great Depression, thanks to a sharp contraction in the money supply, which, in turn, was due to a large number of bank failures and lost deposits.

As discussed in the February 11, 2008 SGS newsletter, and partially repeated here, Federal Reserve Chairman Ben Bernanke addressed deflation risk in a November 21, 2002 speech he gave as a Fed Governor to the National Economists Club entitled 'Deflation: Making Sure ‘It’ Doesn’t Happen Here.'

Attempting to counter concerns of another Great Depression-style deflation, Bernanke explained in his remarks: 'I am confident that the Fed would take whatever means necessary to prevent significant deflation in the United States …'

'Indeed, under a fiat (that is, paper) money system, a government (in practice, the central bank in cooperation with other agencies) should always be able to generate increased nominal spending and inflation, even when the short-term nominal interest rate is at zero.'

'Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.'

The Fed has the will, the perceived mandate and the ability to create as much new money as is needed to prevent a deflation in the prices of goods and services, as measured by the CPI.

Low Treasury Yields Reflect Demand Distortions, Not Inflationary Expectations. Some will argue that Treasury yields are good indicators of what the markets are expecting in terms of inflation, and that the current negative real (inflation-adjusted) yields are suggesting deflation ahead. That generally would be true, if there were not major distortions in the Treasury market.

The primary distortion in the Treasury market of recent years has been the incredible influx of forced investment from abroad by U.S. trading partners stuck with holding excess dollars from the monstrous U.S. trade deficit. With the bulk of net Treasury issuance absorbed by this foreign investment, yields have been severely depressed by factors other than the market’s inflationary expectations. The Treasury market also recently has been picking up some flight-to-safety from disturbances in the financial system, which has placed further downside pressure on yields.

Heavy dollar dumping, which will be seen eventually, will tend to eliminate the current market distortions, spiking yields sharply.

Theoretical Support for Inflationary Contractions. Returning to the price equation:

P = (M x V) / Q,

it offers some simplistic examples of the dynamics of an inflationary economic contraction.

Current Inflationary Recession. In the current environment, rising oil and gasoline prices have spiked broad inflation (P) more rapidly than seen in the money/velocity growth (M x V) combination. Exacerbating an already stagnant-to-negative business environment, the higher relative inflation has been offset with a contraction in economic activity (Q). In simple terms, consumers strapped by higher gasoline tabs also have been forced to cut back on other consumption. More generally, incomes and debt expansion have been unable to keep up with inflation and the inflation-adjusted business activity is shrinking.

Hyperinflationary Great Depression (see the Hyperinflation Special Report). In an environment such as was seen with Weimar Republic hyperinflation, consider the following stories that came out of that inflationary horror. At one time, when one went into a restaurant, it was common to negotiate and pay for the meal in advance, as its price would be higher at the end of the meal. Further, a fine bottle of wine ordered for dinner one night would be worth more as scrap glass in the morning than it had been as a full bottle of wine the night before. Under such circumstances, prices (P) surge ahead of money growth (M), where velocity (V) cannot possibly keep up with the hyperinflation, and basic economic activity (Q) collapses.

Various Money Measures

Shown on the following pages is series of graphs plotting comparative annual growth rates in various measures of U.S. money supply from 1970 to date. Except for the Austrian/True Money Supply measure, where the year-to-year change in the monthly average is based on not-seasonally-adjusted (NSA) numbers, all the money series reflect annual change in seasonally-adjusted (SA) terms. As with retail sales, there are legitimate seasonal variations in money supply tied to the timing of holidays, tax payment days, etc. For purposes of the comparative graphs, however, the differences between the adjusted and unadjusted series are not significant. Shown up front for comparison purposes are graphs of unadjusted year-to-year change in the CPI-U (and the SGS-Alternate CPI as discussed in the August 2006 SGS newsletter), and Money Supply M3, the broadest money supply measure, which I find most useful in assessing the inflation outlook. The plotted money series:

M3 (and SGS Continuation after February 2006)

June average (SA): $13,835 billion, year-to-year change: 15.8%

Significant correlations (year/year change): 77.4% with M2

Description:M3 is M2 (56% of M3) plus large savings instruments, repos and Eurodollars. Per the Fed, the non-M2 components were balances in institutional money market mutual funds; large-denomination time deposits (time deposits in amounts of $100,000 or more); repurchase agreement (RP) liabilities of depository institutions, in denominations of $100,000 or more, on U.S. government and federal agency securities; and Eurodollars held by U.S. addressees at foreign branches of U.S. banks worldwide and at all banking offices in the United Kingdom and Canada. Large-denomination time deposits, RPs, and Eurodollars excluded those amounts held by depository institutions, the U.S. government, foreign banks and official institutions, and money market mutual funds.

The Federal Reserve ceased reporting M3 in March 2006; Shadow Government Statistics publishes an ongoing series based on continued Fed reporting of major M3 components and SGS modeling of missing components, cross-checked with quarterly flow of funds data (see the August 2006 SGS newsletter).

M2

June average (SA): $7,687 billion, year-to-year change: 6.1%

Significant correlations (year/year change): 77.4% with M3

Description:M2 is M1 (18% of M2) plus savings and small savings instruments. Per the Fed, the non-M1 components are savings deposits (including money market deposit accounts); small-denomination time deposits (time deposits in amounts of less than $100,000), less individual retirement account (IRA) and Keogh balances at depository institutions; and balances in retail money market mutual funds, less IRA and Keogh balances at money market mutual funds.

M1

June average (SA): $1,386 billion, year-to-year change: 1.5%

Significant correlations (year/year change): 68.3% with Monetary Base, 49.8% with Austrian

Description: M1 basically is cash and near-cash in circulation plus checking accounts. Per the Fed’s description, M1 includes currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; travelers checks of nonbank issuers; plus demand deposits (checking accounts) at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and other checkable deposits (OCDs), consisting of negotiable order of withdrawal (NOW) and automatic transfer service (ATS) accounts at depository institutions, credit union share draft accounts, and demand deposits at thrift institutions.

Monetary Base (Federal Reserve Board, Adjusted)

June average (SA): $833 billion, year-to-year change: 1.6%

Significant correlations (year/year change): 91.1% with Currency, 68.3% with M1

Description: Currency in the money stock plus reserves of depository institutions, adjusted for changes to reserve requirements. The dominant (92%) questionable Currency component (see below) makes this series of limited value. As to bank reserves reflecting Fed policy, a number of the broader money components do not have reserve requirements, and the Fed is working actively to by-pass reporting as reserves some of the cash it is putting into the system.

Currency in the Money Stock

June average (SA): $769 billion, year-to-year change: 1.7%

Significant correlations (year/year change): 91.1% with Monetary Base

Description:The currency component of M1. A significant portion (in excess of 50%) of this currency circulates outside the United States in 'dollarized' countries and as a store-of-wealth and thus should not be counted as part of U.S. money supply. The amount circulating outside the U.S. has not been well quantified, and the distortions make both the Currency measure and Monetary Base of limited analytical value versus the U.S. economy and inflation.

MZM (Money Zero Maturity)

June average (SA): $8,735 billion, year-to-year change: 15.6%

Significant correlations (year/year change): 87.3% with Austrian (True Money Supply)

Description: Calculated by the St. Louis Fed, MZM is M2 less small time deposits, plus institutional money funds. The components are items such that money is available immediately, without any investment term or withdrawal penalties. The MZM concept is similar to the Austrian measure, but the Austrian measure does not include money market funds.

Austrian Money Supply (a.k.a. True Money Supply)

June average (NSA): $5,474 billion, year-to-year change: 4.5%

Significant correlations (year/year change): 87.3% with MZM, 49.8% with M1

Description:Published by the Ludwig von Mises Institute (Mises.org). As described by the Mises organization, the True Money Supply (TMS) 'consists of the following: Currency Component of M1, Total Checkable Deposits, Savings Deposits, U.S. Government Demand Deposits and Note Balances, Demand Deposits Due to Foreign Commercial Banks, and Demand Deposits Due to Foreign Official Institutions.'

The TMS 'was formulated by Murray Rothbard and represents the amount of money in the economy that is available for immediate use in exchange. It has been referred to in the past as the Austrian Money Supply, the Rothbard Money Supply and the True Money Supply. The benefits of TMS over conventional measures calculated by the Federal Reserve are that it counts only immediately available money for exchange and does not double count. MMMF [money market mutual funds] shares are excluded from TMS precisely because they represent equity shares in a portfolio of highly liquid, short-term investments which must be sold in exchange for money before such shares can be redeemed…'

While the money market funds technically are as per the TMS descriptive, most holders of those funds have immediate availability to their money and view same as the equivalent of cash. In the case of institutional money funds, the vehicles often are used to park funds overnight. Accordingly, the money fund measures are included in the broader MZM measure, which otherwise is similar in concept to the TMS.

Addressing Common Questions/Issues

Imploding Debt and Debt Defaults Do Not Collapse Money Supply. In order for loan defaults, for example to reduce money supply directly, the defaults would have to affect money supply accounts. Once a loan is issued, however, the cash is in the system, and the events leading to the subsequent default rarely have any direct impact on the various money measures.

Where loan defaults can affect money supply, however, is when a losing bank — shy on capital — has to reduce its new lending. That impacts the creation of new money supply and is one reason why Mr. Bernanke is working so feverishly to provide liquidity to a solvency-impaired banking industry.

Monetary Base Has Been Moving Opposite CPI Since 2001. Claims that lack of growth in the monetary base portends deflation lack credence. First, as mentioned earlier, the monetary base data are skewed by a majority portion of the dominant currency-in-circulation measure being physically outside the United States. Second, as shown in the graphs, the pattern of annual growth in the monetary base has been moving opposite to the pattern of growth in the CPI since 2001, with little obvious dampening impact on inflation.

No Conflict between Weak Growth in M1 and Strong Growth in M3 Signals. As discussed earlier, in times of low interest rates — particularly negative real (inflation adjusted) interest rates — there should be a greater turnover in cash or in velocity (V). Relative velocity also is greater for cash and checking accounts (demand deposits) than for time deposits, and accordingly also would also be higher for M1, M2, MZM and the Austrian Money Supply than it would be for M3. The strong annual growth seen in M3 times it velocity might be just as high and just as inflationary as the weaker M1 growth times its much higher velocity. If the M measure (M1 or M3) is in place, along with inflation (P) and real GNP growth (Q), then the velocity measure (V) would in theory make up the difference between the otherwise disparate stories being told by M1 and M3.

Broadest Money Measure Gives Most Complete Picture. Recent data provide a good example of why the broadest money supply measure available should be used when assessing monetary conditions. Very simply, changes to the levels of narrower money measures may reflect nothing more than cash moving into or out of broader money accounts, instead of reflecting a sudden shift in Fed policy.

Consider that M1 has shown flat-to-negative annual growth for the last couple of years. Suddenly, in June 2008, M1 jumped to 1.5% annual growth. Rather than a shift in Fed policy, which might have been deduced by someone relying only on M1, the relative M1 growth appears to have been at the expense of some cash shifting out of M2 accounts to checking accounts in M1. In contrast, M3 picks up all the changes in the system, reflecting net changes to the system, not just changes to a narrower subset of accounts in M1 and M2.

In a related vein, the broadest money measure best reflects how much the system’s cash-participants believe they have to spend. It is for that reason, that the broadest money measure also is the best indicator of future inflationary pressuresfrom the money supply.

Practical Inflation Forecasting.

While CPI certainly is not the GNP’s idealized implicit price deflator, the two measures nonetheless are closely enough related that money growth indeed is an important factor in forecasting CPI inflation.

I have spent the last 25-plus years attempting to generate meaningful and useable forecasts of future economic and inflation activity. Those that have followed my newsletter for some time know that my indicators had been signaling well in advance an inflationary recession, which increasingly appears to be in place in a broad spectrum of economic data (GDP/GNP excepted). One of the top indicators of CPI inflation is money growth. Over time, the broadest money measure (M3) has worked as the best single inflation predictor.

My modeling is not based on the money equations, though, but rather on estimating annual CPI growth as a function of leading indicators, dominated by annual growth or change in M3, the U.S. dollar, oil prices, and several measures of real economic activity and labor activity.

Although off its historic high annual growth of 17.4% in April, year-to-year M3 change was roughly 15.8% as of the June 2008 average. Outside the present period, the current high rate of growth was last seen in 1971, just prior to President Nixon closing the gold window and imposing wage and price controls in August of that year. That current circumstance, based on M3 and other factors signals an intensifying inflationary environment well into 2009.

[1] The core PCE deflator is the inflation rate used in deflating the personal consumption expenditure component of GDP, net of food and energy inflation, and on a substitution weighting basis. Those last two qualifications make the inflation number irrelevant to consumers looking for a measure of the cost of living for maintaining a constant standard of living.

- Switch Products

- Economic Research Resources

Explore resources provided by the Research Division at the Federal Reserve Bank of St. Louis.

- FRED Tools

- Economic Research Resources

- Switch Products

- Economic Research Resources

Velocity Of M2 Money Supply

Source:Federal Reserve Bank of St. Louis

Release: Real Money Stock Measures

Units:

Frequency:

Notes:

This series deflates M2 money stock (https://fred.stlouisfed.org/series/M2SL) with CPI (https://fred.stlouisfed.org/series/CPIAUCSL).

Suggested Citation:

Federal Reserve Bank of St. Louis, Real M2 Money Stock [M2REAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2REAL, August 6, 2021.

Related Resources

Related Categories

Sources

Releases

Tags

Are you sure you want to remove this series from the graph? This can not be undone.