Money supply comprises currency—dollar bills and coins issued by the Federal Reserve System and the U.S. Treasury—and various kinds of deposits held by the public at commercial banks and other depository institutions such as thrifts and credit unions. On June 30, 2004, the money supply, measured as the sum of currency and checking.

Click to see full answer.

Also to know is, why does interest rate increase when price level increases?

Real Money Demand Decreases Due

This means that money demand exceeds money supply and the actual interest rate is lower than the new equilibrium rate. Thus an increase in the price level (i.e., inflation) will cause an increase in average interest rates in an economy.

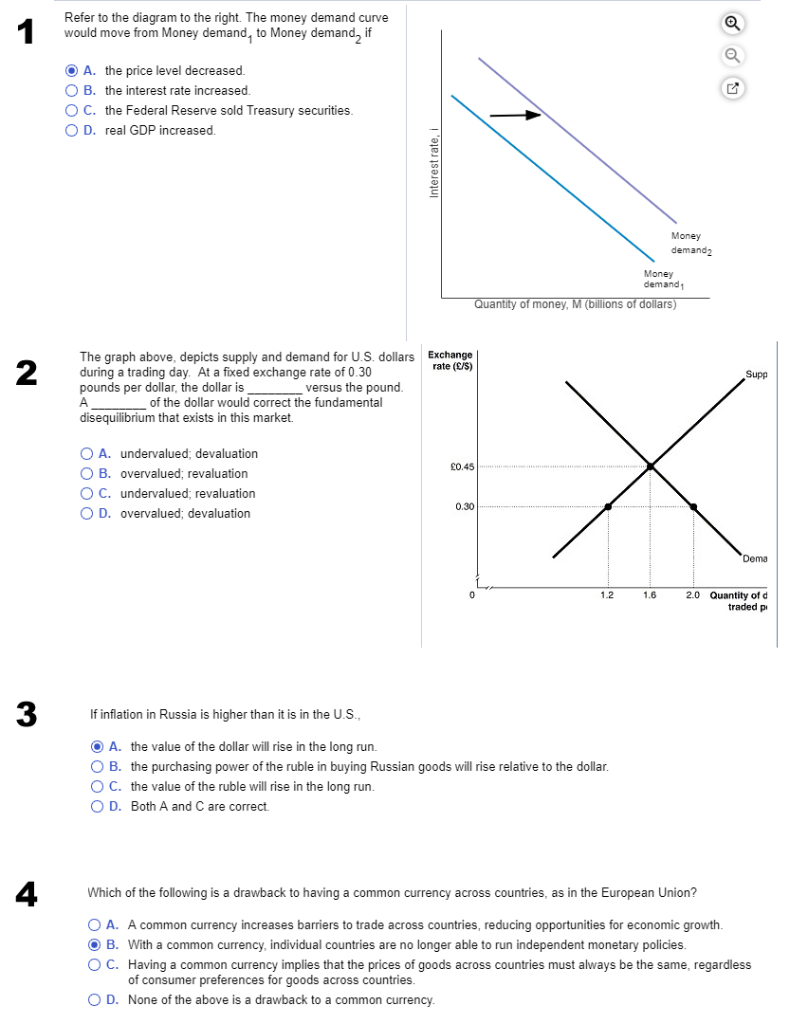

Secondly, what is the relationship between the demand for money and the interest rate? When money demand increase, for all interest rate level, the quantity of money demand will increase. Thus, the whole money demand curve shifts rightwards. It will achieve another equilibrium in money market, where the interest rate level is higher than initial equilibrium interest rate.

Real Money Demand Decreases

Similarly one may ask, why does an increase in income increase money demand?

Real Money Demand Decreases As A

Because it is necessary to have money available for transactions, money will be demanded. The total number of transactions made in an economy tends to increase over time as income rises. Hence, as income or GDP rises, the transactions demand for money also rises.

How do interest rates affect the demand for money?

What Is Real Money Demand

Interest Rates and the Demand for MoneyWhen interest rates rise relative to the rates that can be earned on money deposits, people hold less money. When interest rates fall, people hold more money.