Have you ever considered what equity really costs the entrepreneur? Historically, relying on venture capital (VC) has been one of the only options available to entrepreneurs seeking seed capital, but the cost of this model to founders is far greater than most realize, and it’s not the only option.

- Money Cost Of Capital And Real Cost Of Capital Income

- Money Cost Of Capital And Real Cost Of Capital Ratio

- Money Cost Of Capital And Real Cost Of Capital Definition

As a venture capitalist with over a decade of experience, I know the real cost of equity and what drives that cost. Let me give you a breakdown of the hidden cost of Venture Capital to entrepreneurs, based on my experience. SaaS business founders and early investors need to understand these costs, and what their other options are, before seeking that first institutional round.

Live in the Property for 2 Years. When you sell a property that you’ve lived in for at least two of the. 6.2 The Value of Debt Capital and Capital Cost 80 6.3 The Tax-Deductibility of Debt 84 6.4 The Impact of Issue Costs 87 6.5 Summary and Conclusions 89 7 Capital Gearing and the Cost of Capital 91 7.1 The Weighted Average Cost of Capital (WACC) 92 7.2 WACC Assumptions 93 7.3 The Real-World Problems of WACC Estimation 95.

- Venture capital funds need to provide significant returns, after all costs, to their own investors.

Typically, VC’s advertise to their own prospective investors that they will provide a 25% return on the investor’s capital over a period of 10 years. On top of this return, VCs deduct management fees, audit, and legal costs, which can amount to as much as 15% of the total capital of the fund over the life of the fund. The capital that’s actually available for investment ends up being approximately 85% of the total capital raised.As a consequence, a typical venture capital fund will seek to achieve a return of 3 times the original capital raised, in order to earn the 25% net to investor return as well as cover the operational costs of the fund. A VC having raised a $100 million fund will seek $300 million in exits. Keep in mind that only $85 million of the $100 million was actually invested, while the rest was consumed by management fees, audit and legal costs. - The assumption that 8 out of 10 startups will fail or break even (and that your successful startup must pick up the slack) is built into the way venture capital funds structure their investments.

The typical VC is operating under the rule of thumb that only two out of every ten companies in a portfolio will actually be successful. It’s assumed that four or five of the companies in this same portfolio will return only the capital invested, and three or four will likely fail, bringing no return at all.So, in our example, where does the actual burden of returning the $300 million to a VC fall? If we’re using the assumptions that most VCs are making, this burden falls upon two companies in the portfolio, not ten. Of these two companies, each likely received a total investment of $10 million from the venture fund, over multiple funding rounds. - The returns expected from you as an entrepreneur are far higher than you think.

Together, then, these two hypothetical companies in the VC’s portfolio received $20 million, and are now expected to collectively return $300 million to the VC.That’s a return of approximately 15 times the amount invested.That equates to a cost of over 100% per annum for your equity.My example might seem like an extreme scenario, but it gives you an idea of what the VC investing in your business is thinking, assuming, and expecting. Returns need to be much higher than 5 or 10 times the original investment, and all board decisions will be driven by this framework. which is often invisible to entrepreneurs.

There is another option.

- Revenue financing allows you to retain precious equity in your company.

In some cases, finding the right VC partner can certainly provide added value, especially if that partner can help maximize growth by providing certainty of capital, international connections, customer introductions, or strategic relationships. However, it’s crucial for entrepreneurs to understand the true cost benefit ratio of selling their equity to venture funds. One of the CEO’s primary jobs is to chart the company’s course of growth, and if this growth requires raising capital, #CapitalEfficiency should be the top of mind concern for entrepreneurs.

The team at TIMIA Capital includes several former VCs that have successfully designed and executed another option: revenue financing. Revenue financing is an alternative model that providing funding to entrepreneurs without requiring them to give up equity in their companies.

When you connect with us at TIMIA, you can be assured that you’re assessing all the options available to you.

Looking for non-dilutive capital?

TIMIA Capital works with recurring revenue technology

businesses between $2 – $20 million ARR.

Ler em português

When executives evaluate a potential investment, whether it’s to build a new plant, enter a new market, or acquire a company, they weigh its cost against the future cash flows they expect will spring from it. To make sure they’re comparing apples to apples, they discount those future cash flows to arrive at their net present value. Estimating the rate at which to discount the cash flows—the cost of equity capital—is an integral part of the exercise, and the choice of rate has a significant effect on estimates of a project’s or a company’s value. For instance, if you had recently run a discounted cash flow, or DCF, valuation on the UK-based mobile phone giant Vodafone, you would have found that changing the discount rate from 12% to 11.6%—hardly a major change—would have increased the company’s estimated value by 15%, or £13.4 billion.

Of course, not all companies or projects are as sensitive to discount rate changes, but even so, if a company routinely applies too high a cost of capital in its project valuations, then it will reject valuable opportunities that its competitors will happily snap up. Setting the rate too low, on the other hand, almost guarantees that the company will commit resources to projects that will erode profitability and destroy shareholder value. The fact that companies tend to settle on a discount rate and use it as their financial benchmark for long periods of time, regardless of changes that take place in the company or its markets, only compounds the likelihood of error.

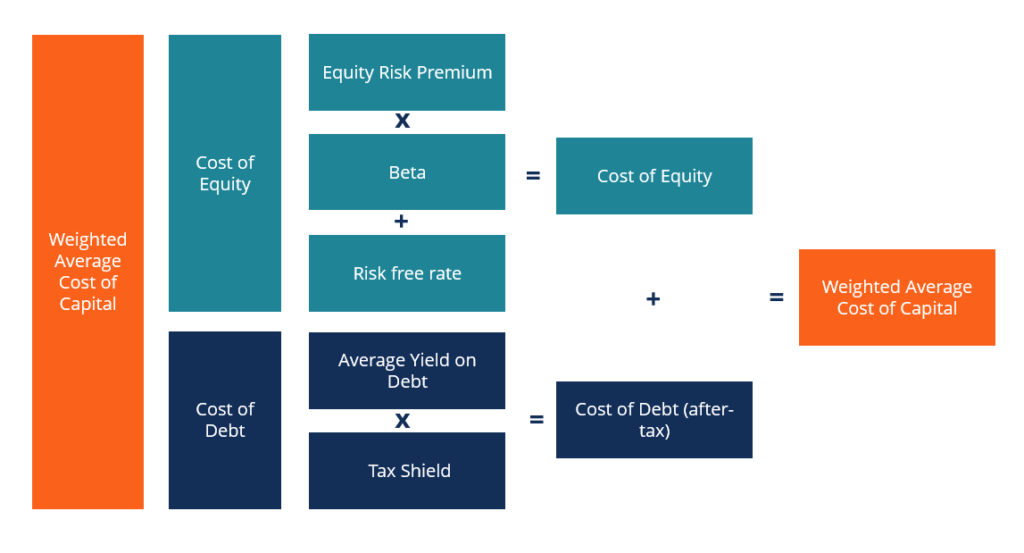

The standard formula for estimating the cost of equity capital—or, depending on your perspective, an investor’s required rate of return on equity—is the capital asset pricing model (CAPM). The formula, which has remained fundamentally unchanged for almost four decades, states that a company’s cost of capital is equal to the risk-free rate of return (typically the yield on a ten-year treasury bond) plus a premium to reflect the extra risk of the investment in question. The premium is the historical difference between the risk-free rate and the rate of return on the stock market as a whole (measured by an index such as the S&P 500) multiplied by an adjusting number to reflect the volatility of the stock and the degree to which it has historically moved up or down with the market.

The adjusting number is called the stock’s beta, and its calculation has long been a source of frustration. A message that we hear repeated in hundreds of conversations with corporate executives and investment bankers is that they fudge their estimates of beta because experience and intuition tell them it is an unreliable measure of a stock’s riskiness. Consequently, they believe the CAPM formula systematically produces inappropriate discount rates. These practitioners are not alone in their doubts; a growing number of academics have also started to question the basic assumptions underlying CAPM and beta. And the practical implications of these reservations are clear: If beta-based measures of a company’s cost of capital are unreliable, the usefulness of the valuation exercise itself is questionable.

As an alternative to CAPM and beta, we’ve developed a new forward-looking approach to calculating a company’s cost of capital, called the market-derived capital pricing model (MCPM). This model is based on the traded prices of equity options on a company’s shares, which means it incorporates the market’s best estimates of the future price volatility of that company’s shares rather than using historical data as in the case of CAPM. Our research shows that the discount rates given by MCPM are more realistic—especially from the perspective of the corporate investor—than the rates generated by CAPM.

What’s Wrong with CAPM?

It’s not hard to see why practitioners are suspicious of CAPM. Beta-based calculations regularly produce cost-of-capital estimates that defy common sense. Take the case of Apple Computer in the mid-1990s. Before the return of founder and CEO Steve Jobs in 1998, Apple was a mess. Its market share was dwindling, its earnings were deteriorating, and its stock price had fallen into the single digits. Intuitively, you would think that investors at that time would have expected a fairly high rate of return on the money they put into the company.

Money Cost Of Capital And Real Cost Of Capital Income

According to CAPM calculations, however, Apple’s cost of equity capital at the end of its five stormiest years (1993 through 1998) would have been just 8%, given the beta generated by that period’s data. By contrast, IBM’s equivalent cost of equity in 1998 would have been 12%, because its beta was twice as large as Apple’s even though its stock price during the period had moved much less wildly and its business outlook was much brighter. What’s more, Apple’s theoretical cost of equity capital in 1998 was lower than the 8.5% yield that bond investors would have demanded from the company, which makes no sense since bondholders have a prior claim on a company’s earnings in terms of interest payments and on its assets in the event of bankruptcy. Our research suggests that anomalies like these can be traced to one or more of three basic problems.

Conflict Between Volatility and Correlation.

As in the case of Apple and IBM, perverse differences in cost-of-capital numbers are often a direct consequence of the fact that beta is a measure of both correlation and volatility. The specific calculation for beta is:

Although Apple’s stock was almost twice as volatile as IBM’s during the five years we looked at (52% share price volatility for Apple compared with 28% for IBM), its correlation with the market’s movement was only one-fourth as great (0.105 for Apple versus 0.425 for IBM). The low correlation more than offset the high volatility, resulting in a beta of 0.47 for Apple compared with 1.09 for IBM. Given a risk-free rate of 5.2% and an historical equity-market risk premium of 6%, these betas produced the perverse results we noted.

Adjusting for correlation can distort estimates of risk, but there is a rationale for doing it. From the perspective of a professional, diversified investor—which financial theory assumes (somewhat questionably) is the profile of all investors—a stock that has a low correlation with the market can serve as a diversifying hedge, a way to reduce the overall risk of the investor’s equity portfolio. A portfolio that contains a low-correlated stock will be less volatile than one that doesn’t because the low-correlated stock will be changing independently of the rest of the portfolio. It could be argued, therefore, that a low-correlated stock’s hedge value to investors justifies a lower cost of equity capital.

But while that might be true for diversified investors, the hedge would certainly have no value to more focused corporate investors who expect total returns on their investments that compensate them for the total risks they are undertaking. In general, corporate investors do not try to reduce risk by diversifying it away; they control it through the good management of operations. The extra value they create by managing well differentiates their company’s performance from that of others. Since they mitigate their investment risks through sound management rather than diversification, they require a higher return on their investments commensurate with their more demanding task. (See the working paper, “New Players, New Rules and New Incentives: Corporate Finance Requires New Metrics,” by James J. McNulty and Tony D. Yeh [Pacifica Strategic Advisors, 2001] for more detail on acquisition and project return metrics for the corporate manager.)

Reliance on Historical Data.

The second problem with beta is that the volatility of the stock and its correlation to the market are computed using data from some past period, which may go back as little as 150 trading days or as much as five years. Unfortunately, beta estimates are notoriously sensitive to minor changes in the time period used. For example, we recently acted as a referee in a dispute between the treasury and finance departments of a UK-based multinational, where the two departments’ beta estimates differed greatly. We demonstrated that even slight alterations, such as a two-day shift in the sampling day (using Friday’s stock prices rather than Wednesday’s) to calculate beta, generated quite different betas of 0.70 and 1.41. Both betas were equally valid in a computational sense, so how could either claim to be a useful predictor of the future?

The problem with using historical data can be avoided, in part, by plugging forecasts of future volatility into the beta formula. These are not that hard to find: Options traders, after all, earn their living by trading on volatility forecasts. But no one has yet devised a method to accurately predict the future correlation of a single stock to the market. Even for a diversified company like GE, past performance is not a useful indicator of correlation. The one-year rolling correlation of GE stock with the S&P 500, of which it is a major component, has ranged between 0.55 and 0.85 over the past four years. Indeed, many academics believe that a company’s stock-to-market correlation is in constant flux, randomly varying between—1 (perfectly negatively correlated) and +1 (perfectly correlated). Since correlations are so variable, it clearly makes no sense to compute a discount rate using historical correlation data—yet this is exactly what you have to do if you base your cost of equity capital on beta.

Indifference to the Holding Period.

A third source of problems with CAPM cost-of-equity numbers is that a company typically calculates just one estimate of its discount rate, which it applies to all future projects it may invest in, regardless of the life or horizon, be it two years or ten. Using a single term can gravely mislead corporate investors because the holding period of a capital investment has a powerful impact on its value.

Both options theory and options trading experience tell us that the marginal risk of an investment (the additional risk that a company takes on per unit of time) declines as a function of the square root of time. If an investment is expected to be worth $100 in one year but has a projected volatility of 20%, then its expected price has a high likelihood of ranging between $80 and $120 (one standard deviation range in one year). But if an investment is expected to be worth $100 in four years and has the same projected volatility, then its expected price will likely range between $60 and $140 (one standard deviation range in four years). In other words, increasing the holding period from one to four years reduces the per annum risk of the investment by 50% (that is, $20 over one year compared with $40 over four years).

The falling marginal risk serves to reduce the annual discount rate. An investor who requires a 21% cost of capital for a one-year equity investment, for example, would require a 13.5% annual rate on a five-year equity investment of a similar risk. The overall riskiness of the longer investment is certainly greater than that of the shorter one–five years of 13.5% is greater than one year of 21%. However, the riskiness increases at a declining rate over time, as reflected in the difference between the annualized rates for the different terms. Just as with interest rates on debt, term structures should be taken into account when calculating rates of return on equity.

Introducing MCPM

The market-derived capital pricing model completely avoids the problems that bedevil the CAPM formula. Our approach draws on information obtainable from the yields on government bonds, corporate bonds, and the traded prices of options. It does not incorporate any measure of historical stock-to-market correlation, relying instead on estimates of future volatility derived from the options market. What’s more, the term of the investment is calculated into the rate, which means that MCPM is customized to fit the expected life of a capital investment.

MCPM is based on the premise that investors require compensation for three kinds of risk. The first type, which we call the national confiscation risk, measures the risk that an investor will lose the value of his or her investment because of a national policy—expropriation, for instance, or confiscatory taxes or a loose monetary policy leading to runaway inflation. The second type, the corporate default risk, reflects the additional risk that a company will default as a result of mismanagement independent of macroeconomic considerations. The third type, the equity returns risk, reflects the extra risk that an equity investor bears because his residual claim on the company’s earnings is secondary to debt holders’ claims in bankruptcy or otherwise.

Putting a numerical value on the first two kinds of risk is fairly straightforward. Compensation for the national confiscation risk is the government bond rate for a given time period. The corporate default risk is the premium above the government bond rate that corporations pay to obtain funds. For companies that have actively traded corporate bonds, the yield on the bonds captures the national confiscation risk and the corporate default risk. Take GE, for example. The sidebar “GE’s Term Structure of Bond Yields” shows how much of GE’s default risk is national and how much is corporate over a ten-year period. The five-year yield for GE’s bonds, for instance, is 4.72%, of which 4.49% is due to national confiscation risk and the remaining 0.23% is compensation for potential corporate default.

It is a bit more complicated to calculate the third kind of risk: the extra premium that shareholders require as compensation for their position at the end of the liquidation line. We’ve broken down the calculation into four steps. Once the excess equity return—the rate required to compensate investors for the equity return risk—for a particular period has been calculated as an annual percentage, you add it to the estimated yield on corporate bonds of matching maturity to obtain the market-derived cost of equity. We illustrate each step by calculating the cost of equity for GE’s five-year term.

Step 1: Calculate the forward break-even price

The first step is to find out just how well the share price must perform in order to compensate equity investors for their additional risk. To do so, we begin by determining the minimal capital gains that equity investors will require. The standard definition of equity returns is the sum of the rate of capital gains and the dividend yield, more formally:

Since the return on equity should be greater than return on debt, it follows that the minimal rate of capital gain that equity investors require on a stock can be no less than the difference between the return on debt and the dividend yield:

The rate of return on the debt is the same as the bond yield. The dividend yield can be obtained by dividing the company’s expected current dividend payout by the share price. Research shows that the current dividend is a good predictor of a company’s long-term dividend stream, probably because companies make a conscious effort not to surprise the markets with unexpected changes in their financial distribution policies. Any such changes are usually signaled well in advance. For GE, therefore, we estimate that the current expected dividend yield is 2.44% given the company’s forecast payout of 72 cents and the current share price of $29.50 (as of June 26, 2002). Subtracting this from the five-year bond yield (4.72%, as determined above) tells us that the minimum required annual rate of capital gains for a five-year investment is 2.28%.

Once we have a number for the minimum required capital gains rate, we can calculate the price a stock must reach at the end of the period to make that rate of return, using the standard future value formula:

where n is the length in years of the investor’s holding period. Applying this formula to GE’s current price of $29.50 and the minimal capital gains rate of 2.28% (the interest rate in the formula), we find that the minimum acceptable stock price in five years is $33.02. If investors expect that GE’s shares will not reach $33.02 in five years, they should buy five-year GE bonds instead.

Step 2: Estimate the stock’s future volatility

Once we’ve worked out the minimum acceptable stock price, we determine how likely it is that a company will fail to reach the target price, because equity investors require compensation for the risk of underperformance. We do this by looking at the prices for options, which reflect the market’s level of uncertainty about a company’s ability to deliver the expected cash flows. If there is considerable uncertainty, then the shares will be very volatile until the actual cash flows prove otherwise.

We determine the degree of volatility using the Black-Scholes pricing model, which is the standard way to estimate option value. Black-Scholes is based on five ingredients: volatility, the current price of the stock, the strike price of the option, the length of time to expiration, and the prevailing interest rate on the company’s bonds for the remainder of the option’s life (reflecting the risks of default). Given the price of an option, its terms, and the prevailing interest rate, we can use the formula to calculate the remaining variable—that is, the market’s expectations on a stock’s volatility between now and the option’s maturity. Thus, if a GE five-year option has a price of $7.37, a strike price of $35, and the current price and the cost of funds to purchase the option are $29.50 and 4.49% respectively, we can determine that the stock will have a volatility of 35%. (For more on options and the Black-Scholes model, see the sidebar “How Options Work.”)

Step 3: Calculate the cost of downside insurance

In this step, we combine our estimate of volatility with the forward breakeven price to determine the price investors would be prepared to pay in order to insure against the chances that their shares will fall below the forward breakeven price. This is the premium that reflects the extra risk of equity over debt.

Once again, that number can be obtained by using the Black-Scholes pricing model. This time, however, the objective is to calculate the value of a theoretical five-year put option (the right to sell in five years the shares an investor owns). The strike price of the option is the forward breakeven price ($33.02), the volatility is that of the traded call option, and the interest rate is the corporate debt rate. For GE, the price of a five-year put option works out to be $7.75, given a spot price of the share of $29.50, a volatility of 35%, and a 4.72% corporate bond yield.

Step 4: Derive the annualized excess equity return

The final stage in calculating the excess equity return is to express the dollar cost of this “insurance” as an annual premium. To do this, we divide the theoretical put option price by the spot price of GE’s stock and convert it into an annual percentage, using the following annuitizing formula:

The term refers to the investment horizon, in this case five years. Applying this conversion formula to the theoretical put price we calculated for GE gives us a rate of excess equity return of 6.02%. (Strictly speaking, we should convert the GE bond rate into a zero-coupon rate, but for the purposes of simplicity, we have used the GE par-bond rate of 4.72%.)

Having obtained the equity risk premium for a particular period as an annualized percentage, we can derive the MCPM rate by adding the premium to the yield on the company’s bonds of the appropriate maturity. In the case of GE, adding the five-year excess equity return of 6.02% to GE’s five-year bond yield of 4.72% gives us a five-year cost of equity capital rate of 10.74%. The sidebar “GE’s Term Structure of Equity Cost” shows GE’s cost of equity across a range of investment horizons. The declining cost-of-equity structure reflects how time affects the impact of volatility on value.

Although it is easier to calculate MCPMs for large companies such as GE, which have many options and futures traded on their stocks across a broad range of maturities, it is possible to derive meaningful rates for smaller companies as well. We usually impute missing data by looking at options written either on comparable companies for the time period involved or by extrapolating from shorter- or longer-dated options, or both.

How Is MCPM Better?

As with any new formula or theory, MCPM should be judged by its results. Does it consistently produce more reasonable and intuitive discount rates than CAPM? Certainly, we found that the 1998 MCPM rate for Apple made more sense at 19.2% than did its CAPM cost of equity at 8%. We did similar comparisons of MCPM and CAPM numbers for hundreds of companies in a wide range of industries with the same result.

Consider the electric utility business before deregulation. Most investors and analysts agreed that the cost of equity for utilities should not have varied greatly across companies or even across countries. After all, this was (and is) a mature business providing a commodity service, using well-established technologies. Indeed, because regulated utilities typically had predictable cash flows, almost as regular as coupons on a bond, their share prices often behaved like corporate bond prices. Nonetheless, the standard CAPM calculation implied discount rates that varied greatly—from 5.1% to 10.3%. Looking closely, we found that the source of the problem was the correlation conflict: Utilities before deregulation varied much more in their degree of historical correlation with the equity market than they did with the bond market. The MCPM calculation, which removes the distorting effect of correlation with the stock market altogether, produced numbers that were far closer together, ranging from only 9.9% to 11.5%.

We also looked at the biotech industry. Here, CAPM seemed to compress the cost-of-capital numbers into an unreasonably narrow range. Take Genomic Solutions, for example, a newer company that went public in 2000. Before the IPO, Genomic Solutions had been owned entirely by venture capital investors, who had expected returns on equity of 30% or more. After just a year as a listed stock, bankers using CAPM estimated that the company’s cost of capital was only 12%, a rate similar to those of established industry players. Anomalies like this vanish if MCPM is used instead. Of the ten biotech companies we looked at, the rates for the newly public ones were consistently higher than the rates for the established businesses. (See the sidebar “Estimated Costs of Capital for Biotech Companies.”)

Further compelling evidence came from our analysis of 32 publicly traded real estate investment trusts (REITs). Regulations require that 90% of the cash flows of these companies be paid out to investors as dividends. The greater the cash flows, of course, the greater the immediately realizable value of the REIT to its investors. As a result, REIT prices tend to trade as a multiple of their current cash flows—specifically, funds from operations (FFO)—divided by the share price, those with more reliable cash flows trading at higher multiples. You would expect the discount rates, therefore, to correlate negatively with FFO multiples. But as the exhibit “Comparing CAPM and MCPM for Real Estate Investment Trusts” shows, for the REITs we looked at, there is almost no relationship between FFO multiples and CAPM discount rates. Once again, the culprit is stock-to-market correlation. Some of the lower yielding REITs also had a high market correlation, which made for a high CAPM rate, and vice versa. By contrast, plotting FFO multiples against MCPM rates reveals a significant relationship.

Money Cost Of Capital And Real Cost Of Capital Ratio

• • •

We’re under no illusions that our approach to calculating the cost of capital will be the final word. However, this method should be useful to CEOs and CFOs who need to hit total return targets to satisfy shareholders. MCPM is a total return measure that is not diluted by guesses at a stock’s correlation to an index, and it has the advantage of being based on forward-looking market expectations, not historical data. This is helpful since these are the same investor expectations that are built into a company’s current stock price. Financial risk management has evolved a great deal in the past 50 years with the development of deeply liquid markets in stock options and futures. MCPM lets corporate managers take advantage of the rich information these markets provide to determine discount rates that can help them increase their probability of creating shareholder value as they make major capital allocation decisions or assess the value of acquisitions.